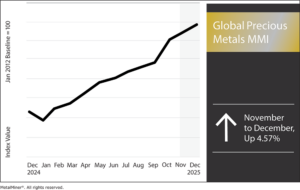

The Global Precious Metals MMI rose by 4.33% month over month. As of mid-November 2025, all four...

Global Precious Metals MMI: Gold Steals the Precious Metals Show in 2025

The Global Precious Metals MMI (Monthly Metals Index) ended the year strong, rising a total of 4.57%.

2025 was a reminder that precious metals markets can move quickly (and sometimes violently) when supply tightens, policy risk rises and investors pile in. Gold and silver reached historic highs, platinum staged a dramatic rally and even palladium found renewed volatility after years of decline.

Palladium Market Still Narrow and Volatile

Palladium remained the weakest performer among precious metals in 2025, largely due to its reliance on gasoline vehicle production. According to Trading Economics data, the continued rise in electric vehicle adoption saw Palladium spend much of the year under $1,000 per ounce.

However, the market was far from quiet. Palladium prices rebounded sharply in the second half of the year as broader precious metals rallied and substitution dynamics resurfaced. As platinum prices surged, automakers again evaluated palladium as a lower-cost alternative in catalytic converters, a trend noted by the World Platinum Investment Council in its 2025 market commentary.

U.S. policy uncertainty added even more volatility. Palladium was included in the Department of Commerce’s Section 232 critical minerals investigation, which raised concerns about future trade restrictions. While no new tariffs materialized during the year, precautionary buying and shifts in inventory into the U.S. at times tightened availability. For U.S. manufacturers, palladium reinforced the risks of sourcing metals with concentrated supply and limited demand flexibility.

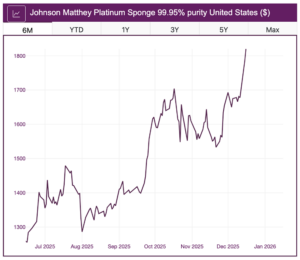

Tight Platinum Supply Meets Demand

Platinum was the standout precious metal of 2025. Prices surged to their highest levels in more than a decade, driven by persistent market deficits and declining above-ground inventories. Johnson Matthey’s 2025 PGM Market Report confirmed that platinum remained in structural deficit, with mine supply continuing to drag the demand side.

Supply disruptions in South Africa, combined with modest recycling growth, left the market exposed. At the same time, demand from automotive, chemical and industrial users remained resilient. The World Platinum Investment Council also highlighted how investment demand rebounded as platinum’s discount to gold narrowed.

U.S. trade concerns further amplified the rally. Fears tied to Section 232 prompted U.S. buyers to pull platinum into domestic warehouses. As indicated by CME Group warehouse data, this contributed to shortages in London and higher lease rates. For U.S. buyers, platinum’s rally underscored the risks of thin markets, as those companies with forward coverage were better positioned than those relying on spot availability.

Silver: A Historic Squeeze

Silver delivered one of the most dramatic price moves of any commodity in 2025, breaking a record that had stood since 1980. According to NASDAQ historical pricing, silver prices more than doubled over the year, eventually reaching a peak above $50 per ounce. The index’s fundamentals were already tight entering 2025, with silver facing its fifth consecutive annual supply deficit. Meanwhile, industrial demand, particularly from solar and electronics, continued to grow. The Silver Institute’s 2025 outlook confirmed record industrial consumption for the year.

What transformed tightness into turmoil was policy risk. Silver’s inclusion in U.S. critical minerals discussions sparked heavy inventory inflows into U.S. vaults, draining liquidity from London and triggering a short squeeze. Meanwhile, London Bullion Market Association (LBMA) data releases tracked elevated lease rates and futures dislocations. For U.S. manufacturers, silver’s rally translated directly into higher input costs and sourcing uncertainty, serving as a stark reminder that industrial metals can behave like financial assets when inventories thin.

Gold: The Anchor in a Volatile Year

Gold also reached new all-time highs in 2025, rising more than 60% as inflation concerns, geopolitical risk and central bank buying converged. According to World Gold Council and Trading Economics data, prices crossed $4,000 per ounce in October. As documented in the World Gold Council’s 2025 demand reports, central banks remained aggressive buyers, absorbing a significant share of global gold supply.

For U.S. companies, gold’s rally mattered less as a direct input cost and more as a signal. It ultimately reinforced broader sentiment in precious metals, supported silver and platinum rallies and reflected a macroeconomic environment in which volatility, not stability, defined the operating backdrop.

Precious Metals Prices: Noteworthy Price Shifts

- Palladium bar prices moved sideways, dropping 0.7% to $1,428 per ounce.

- Platinum bar prices rose 4.62% to $1,676 per ounce.

- Silver ingot prices rose 18.12% to $1,906.40 per ounce.

- Lastly, gold bullion prices rose 6.02% to $4,233.50 per ounce.