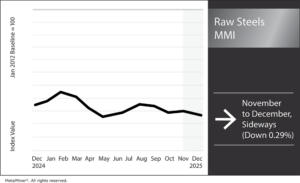

The Raw Steels Monthly Metals Index (MMI) remained sideways, with a modest 0.32% increase from...

Raw Steels MMI: U.S. Steel Prices Confirm Uptrend, Where Will They Peak?

The Raw Steels Monthly Metals Index (MMI) remained sideways, falling 0.29% from November to December.

U.S. Steel Prices Confirm Uptrend

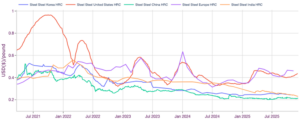

Uninterrupted increases beginning in late September pushed HRC prices to a five-month high by early December. They now sit at $873/st, a 9.5% increase from their most recent bottom. HRC prices are not alone, with both CRC and HDG mounting similar rebounds over recent weeks as the U.S. flat rolled steel price trend shifted from sideways to up.

Still, compared to past years' uptrends, the current price trend appears noticeably less sharp. While maintenance outages, combined with a slowdown in imports since late Q1, tightened supply conditions enough to invert the trend, demand conditions remain soft, offering little momentum for prices.

And though mill lead times have lengthened, those increases have proven relatively modest thus far. By the end of November, HRC lead times sat almost on par with their historic average. Meanwhile, service center sources indicated little interest in substantially rebuilding their inventory stocks, particularly as the end of the year approaches.

Mills Hold Back Tons

Domestic mills appear well-aware of the lack of overall market momentum. While maintenance outages are mostly complete, output remains short of the levels reached during the summer months.

According to data from the American Iron and Steel Institute, output fell to its lowest level since mid-May as of early December. This suggests mills are strategically keeping at least a certain volume of output offline to maintain a firm price trend and retain control of the market.

Lower import volumes are aiding these efforts. Data from the Census Bureau shows that November HRC, CRC and HDG sheet and coil imports into the U.S. fell considerably year over year. This is mainly the result of tariffs, which have successfully blocked a substantial volume of offshore imports from the U.S. market.

With U.S. rates on the rise, the gap between U.S. and Asian prices is widening. However, the U.S. price premium has yet to attract higher import volumes, especially given the substantially longer lead times.

How High Can Steel Prices Climb?

One service center noted that HRC prices would need to reach between $900/st and $1,000/st for imports to become more desirable to U.S. buyers. That would mean HRC prices would need to rise by roughly $100/st before mills begin to struggle to keep the price trend to the upside.

HRC futures seem to echo that sentiment. Futures found a peak at $920/st in early December before they began trending sideways. While futures are not always accurate indicators of where prices will peak, the lack of a strong uptrend over recent weeks suggests that investors remain cautious about how high spot prices are likely to climb before they find their next meaningful apex.

What’s Coming in 2026

The Federal Reserve continues to cut interest rates, which will ease current pressure on leading end-use sectors like construction and manufacturing. However, U.S. construction spending remains considerably lower than it was the previous year.

Meanwhile, U.S. manufacturing remained in contraction as of November. Service centers noted some optimism regarding demand from data center construction, but those sources appeared skeptical as to whether that would be enough to compensate for the overall demand softness.

This comes as many trade deals have yet to be ironed out. While the EU and UK negotiated framework agreements, there is still some hope that steel quota arrangements could be agreed upon. This would likely increase import supply, thus limiting the current level of control that domestic mills have over the U.S. market.

Finally, Canada and Mexico have yet to reach deals with the U.S., both of which would likely also include some form of a quota arrangement. If and when these are announced, they would have a downside impact on U.S. steel prices.

Biggest Moves for Raw Material and Steel Prices

- LME scrap prices rose 4.24% to $369 per metric ton as of December 1.

- U.S. Midwest HRC futures witnessed a 3.14% increase to $920 per short ton.

- Meanwhile, Chinese HRC prices slid 1.06% to $422 per short ton.

- Chinese steel slab prices fell by 1.18% to $505 per metric ton.

- Chinese coking coal prices plunged 17.64% to $150 per metric ton.