The Rare Earths MMI (Monthly Metals Index) began the year by dropping 3.27%. As we enter Q1 of...

Rare Earths MMI: 2025 Rare Earths Roundup

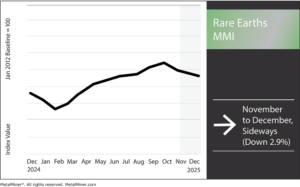

The Rare Earths MMI (Monthly Metals Index) moved sideways, dropping by 2.9%.

The rare earths market experiences a pretty intense roller coaster ride throughout 2025.

Back in April, Beijing dramatically expanded export controls on rare earth elements (REEs) and magnets, imposing stringent licensing requirements on seven medium and heavy REEs. The list included samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium. Simultaneously, several U.S. companies were placed on China’s export-control list. The restrictions targeted precisely the heavy rare earths for which the U.S. currently lacks domestic production.

The move was announced just ahead of President Trump’s state visit to Asia and was widely seen as retaliation for U.S. tariffs. According to a CSIS Q&A in April 2025, Chinese permits were predicted to pause exports and disrupt supplies to U.S. aerospace and defense firms. CSIS analysts wrote that these new Chinese rules, which took effect on December 1, expand export licensing and prohibit exports to foreign military end-users and to end-uses designated as restricted. This includes certain foreign-made items containing Chinese-origin REEs or magnets.

U.S. Alliances and Policies: Building a New Supply Chain

Washington responded to the squeeze with a range of strategic initiatives. In October 2025, the White House announced a U.S.-Japan Critical Minerals Framework designed to pool policy tools and investment to build diversified mining and processing outside of China. The framework committed both governments to fast-track permitting, financing and stockpiling of rare earths (and by extension, magnets) for their industries.

The U.S. is also continuing active “mineral diplomacy” with its allies. For instance, the Trump administration’s first state visit to Saudi Arabia included talks on rare earths Several weeks later, U.S. mining firm MP Materials signed an MOU with Saudi Arabian Mining Company (Ma’aden) to co-develop a mine-to-magnet supply chain. Under that deal, Ma’aden will build a new heavy-rare-earth mine and refinery and work with MP to make permanent magnets, with production expected by 2028.

Another major industrial pact came in October 2025 when Noveon Magnetics, the only U.S. maker of sintered rare-earth magnets, signed a memorandum of understanding with Lynas Rare Earths to jointly construct a full magnet supply chain in the U.S. Under the non-binding MoU, Lynas will supply both light and heavy rare earth oxides to Noveon’s Texas operations, enabling the production of high-performance magnets for defense systems, electric vehicles and robotics. As Noveon CEO Scott Dunn noted, the partnership can “offer a total solution today, not five years from now” for U.S. security needs.

Policy Shifts and Incentives: A Mixed Picture

On the policy front, 2025 has been a tale of two halves. In the first part of the year, U.S. agencies signaled strong support for critical minerals. The Interior Department’s USGS published its 2025 Critical Minerals List in November, again highlighting rare earth elements as vital to defense and tech.

The government noted that the U.S. still imported roughly 80% of its rare earths in 2024, but is “mapping new domestic deposits” to change that dynamic. Meanwhile, just this week (December 1, 2025), the Department of Energy announced a new funding competition of $134 million to strengthen REE supply chains.

In mid-2025, Washington also altered key incentives. The passage of the so-called “One Big Beautiful Bill Act” (H.R.1) on July 4, 2025, rolled back much of the previous administration’s green-energy incentives, including ones that would have driven demand and production of rare earths.

Notably, the $7,500 electric-vehicle tax credit was terminated, potentially dampening future demand for REE magnets in EV motors. The bill also phases out the Section 45X tax credit for domestic mineral production by 2033, which had previously been extended indefinitely for critical minerals.

What This Means for U.S. Buyers

For U.S. procurement and finance executives, the message is clear: rare earths remain a strategic commodity, and 2025’s developments have raised both risks and opportunities. From Chinese export bans to new alliances and funding, the extraordinary volatility means supply strategies must adapt.

In practice, buyers may need to diversify sources and work closely with government programs. For example, the recent Noveon–Lynas and MP–Ma’aden deals signal the growing availability of U.S. and allied-supplied rare earth materials. On the other hand, the market still overwhelmingly relies on China for processing, especially for heavy rare earths. Even with new U.S. facilities under construction, domestic producers won’t rival Chinese capacity anytime soon.

Looking ahead, business and government must act in concert. The White House and U.S. allies have committed to ramping up mining and refining, but success depends on stable policies and sustained investment. Companies should monitor ongoing talks, such as the U.S.-Japan technical working groups, and take advantage of funding opportunities, such as DOE’s recent NOFO.

They should also engage in the new bilateral supply chains. For instance, executives at American OEMs might consider forming partnerships with Lynas, MP or new recyclers to lock in supply. Finally, it will be crucial to track how consumer demand evolves. Without strong demand signals (for example, robust EV adoption), costly new projects may stall.

In conclusion, 2025 showed that rare earths are not just a niche issue. Instead, these minerals sit at the intersection of geopolitics, national security and technology. For U.S. metal buyers, the year brought sobering lessons about dependence on foreign sources, but also encouraging signs of domestic build-out.

Rare Earths MMI: Noteworthy Price Shifts

- Yttrium prices moved sideways, rising 1.64% to $30.97 per kilogram.

- Dysprosium oxide prices dropped 5.32% to $207.68 per kilogram.

- Neodymium prices moved sideways, rising 0.87% to $96,490.11 per metric ton

- Lastly, terbium oxide prices also moved sideways, rising 0.32% to $922.01 per kilogram.