The Copper Monthly Metals Index (MMI) accelerated from the previous month, rising 6.31% from...

Copper MMI: Copper Prices Continue Uptrend

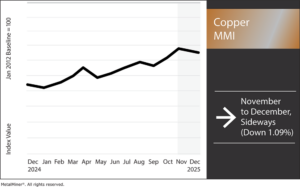

The Copper Monthly Metals Index (MMI) moved sideways, with a modest 1.09% decline.

Copper Prices Remain Bullish

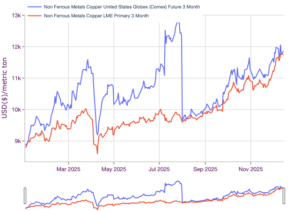

Global copper prices are ready to close 2025 in a decidedly bullish trend. Both Comex and LME copper prices continued to break above their respective ranges, signaling that their uptrends remain intact despite brief pauses in November and mild sell-offs in mid-December. While there are still concerns regarding global supply and weak data out of China, overall momentum remains strong.

Comex Premium Dips, but U.S. Continues to Stockpile

As of December 17, LME copper prices are hovering near an all-time high at $11,735/mt. Comex copper prices remain beneath their July peak, but have nonetheless appreciated over the last month to where they currently stand at $11,921/mt.

Notably, the nearly year-long bifurcation between the two contracts has appeared relatively narrow over recent weeks. In order to attract material, LME prices have been forced to compete with U.S. prices.

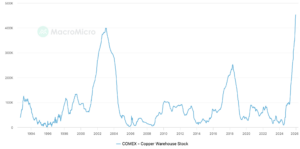

Meanwhile, the U.S. market continues to stockpile material. Despite climbing far above both their LME and SHFE counterparts, Comex inventory stocks remain on the rise, consistently hitting new all-time highs. While AI and data centers are expected to offer ongoing demand for copper in the coming years, regardless of other economic headwinds, the U.S. market appears primarily concerned with the possibility of expanded tariffs.

For now, 50% copper tariffs have been isolated to semi-finished material, with the White House opting to exclude refined material back in July. However, the administration did leave the door open for those duties to expand in the coming years.

Copper’s addition to the Critical Minerals list and new regulatory requirements for copper smelting offer a strong signal of U.S. intentions to incentivize domestic refining capacity, tighten supply-chain oversight and gradually reduce reliance on foreign refined copper as strategic and electrification-driven demand accelerates.

This policy trajectory remains bullish for copper prices because it reinforces demand, even though the U.S. market appears well-supplied. By signaling potential future tariffs on refined copper and simultaneously lowering regulatory hurdles for domestic smelting, the U.S. is encouraging onshore processing but also increasing uncertainty around future trade flows.

Even without immediate tariff expansion, the possibility of broader duties raises the risk premium embedded in copper pricing and can disrupt established supply chains, supporting higher prices. Despite moves to expand domestic capacity, the U.S. remains a net importer of copper. Tariffs will invariably raise the price floor for the red metal in the U.S. market, and investors appear keen to secure material ahead of potential duties.

When Will Tariffs Hit?

Goldman Sachs noted that any tariff announcements are unlikely to occur during H1, as inflationary pressures are expected to deter such moves. This does not mean refined tariffs are off altogether; just that any such duty may prove a longer-term rather than a short-term threat.

Beyond inflation, other limitations could delay expanded tariffs. For instance, primary smelting capacity is constrained to only two main domestic smelters, creating a large processing deficit even as mining output grows. This means much of the United States’ mined copper is still shipped abroad for processing. While efforts by the current administration may aim to see that capacity grow, doing so will take some time.

Assuming copper tariffs remain a looming but not immediate threat, the U.S. will likely continue to stockpile. Regardless of demand conditions, this will offer support to copper prices.

Supply Surplus or Deficit?

As copper prices rise, it remains unclear whether fundamentals will offer strong support through the medium term. While some forecasts point to a global supply deficit emerging as early as 2026, others argue the market may still slip into surplus before longer-term tightness takes hold.

This disagreement reflects diverging assumptions around how quickly new supply comes online versus how fast demand from electrification, grid expansion and data centers ultimately materializes. The uncertainty matters because sustained deficits would justify structurally higher prices, whereas even modest surpluses could limit upside despite strong sentiment. This is especially relevant as the U.S. will eventually have to contend with the results of stockpiling efforts.

On the bullish side, deficit-focused forecasts emphasize that copper demand growth is becoming increasingly driven by policy and technology, making it less sensitive to traditional economic cycles. Long project lead times, declining ore grades and underinvestment over the past decade raise the risk that supply will struggle to keep pace, particularly later in the decade.

This view argues that even if inventories appear adequate in the near term, underlying fundamentals are tightening. This argument has been echoed by analysts cited in The Northern Miner, who frame the coming imbalance as structural rather than speculative.

However, more cautious outlooks suggest that supply growth and easing policy risks could keep the market balanced, or even slightly oversupplied, through 2026. Despite raising its copper price forecast, Goldman Sachs still projects a surplus in the coming year, noting that tariff risks have moderated and production growth remains sufficient in the near term. Under this scenario, prices can stay elevated due to risk premiums and strategic positioning, but lack the sustained physical tightness typically required for a prolonged rally.

The contrast between these views highlights how fragile the current trend is. Copper prices remain sensitive to relatively small changes in supply-demand assumptions, suggesting volatility will likely persist as the market searches for clearer signals.

Biggest Copper Price Moves

- Korean copper prices rose 5.28% to $12.43 per kilogram as of December 1.

- Chinese copper wire prices moved sideways, rising 2.43% to $13,087 per metric ton.

- Meanwhile, Chinese copper scrap prices fell by a modest 1.32% to $12,218 per metric ton.

- U.S. copper producers prices for grade 102 dropped by 4.01% to $6.47 per pound.

- U.S. copper producer prices for grades 110 and 122 fell by 4.16% to $6.22 per pound.