The Automotive MMI (Monthly Metals Index) moved sideways, rising by a modest 2.48%. Recent...

Automotive MMI: U.S. Auto Industry Ends a Turbulent Year

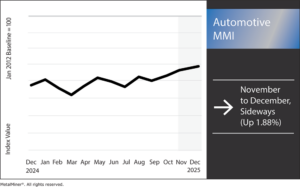

The Automotive MMI (Monthly Metals Index) moved sideways, edging up by a slight 1.88%.

The past year fundamentally reshaped the automotive manufacturing business in the U.S. Between aggressive trade policy shifts, rising domestic production costs and extreme volatility across steel, aluminum and copper markets, 2025 forced procurement leaders to confront the raw math of sourcing metals under a new reality.

2025 Tariffs Rewrite the Cost Structure for U.S. Automakers

Tariffs were the dominant factor impacting automotive metal markets throughout the year. Duties for steel and aluminum imposed under Section 232 jumped from 25% to 50%, and many additional items (from brackets to entire chassis assemblies) were also assigned a 50% tariff rate. This means products that had previously faced a 25% tariff suddenly carried much harsher penalties.

By October, U.S. manufacturers had incurred upwards of $10.6 billion in tariffs on vehicles and components purchased from Canada and Mexico, while BCG estimated that the overall tariff exposure for metal-intensive industries was nearing $50 billion. As Trump emphasized, the message was unmistakable: “If you want your tariff rate to be zero, then you build your product right here in America."

Automakers Pull Guidance as Margins Get Hit

It didn't take long for the effects of the financial crisis to appear during earnings calls. Mercedes-Benz announced a 41% drop in Q1 profits and retracted its full-year forecasts, indicating that tariffs could significantly reduce profit margins. Eventually, both Stellantis and Volvo halted their guidance, citing uncertainties around tariffs and challenges in predicting their business impact.

Ford estimated around $2.5 billion in tariff-related expenses, while GM projected an impact of $4 billion to $5 billion. Analysts cautioned that inflation in materials driven by tariffs could increase the cost of a typical new vehicle in the U.S. by several thousand dollars as the higher input costs are passed on to consumers.

Steel, Aluminum and Copper Markets Break from Fundamentals

Tariffs didn’t just raise costs; they destabilized pricing. For instance, hot-dipped galvanized steel, the backbone of automotive body construction, jumped nearly 19% in February to roughly $1,120/ton. By April, it had approached $1,200. Buyers rushed to secure material ahead of expected duties, and mills took full advantage. However, fundamentals eventually reasserted themselves. Auto assembly volumes slipped from 2024 levels, and heavy‑truck output saw a sharp double‑digit decline. By midyear, steel prices eased and imports fell sharply. Total steel imports dropped significantly year‑on‑year, with flat-rolled and galvanized products down by roughly half.

Meanwhile, the copper market proved to be its own roller coaster of volatility. Prices soared amid tariff speculation, then fell by 50–60 cents per pound once the final details showed that some key copper forms would be excluded from the steepest tariffs. Aluminum reached a three-year high in the vicinity of $2,800/ton due to Chinese outages, Guinea unrest and surging auto-sector and clean‑energy demand, while a major Middle Eastern producer explored opportunities to expand production closer to U.S. customers.

OEMs Restructure Supply Chains in Real Time

By midyear, procurement leaders weren’t waiting for reassurance. Instead, they were creating it. Automakers locked in multi-year steel contracts with Cleveland-Cliffs and other mills to secure more predictable pricing and reduce tariff exposure. They also diversified supplier bases, qualified new domestic grades, redesigned parts to eliminate imported metal where possible and expanded the use of recycled content. These were practical, non-glamorous steps, and all of them were necessary.

Production footprints shifted as well. Stellantis paused production at Canadian and Mexican facilities, then announced a $13 billion U.S. investment to expand domestic manufacturing, the largest in its history. Because tariffs changed the economics of where a vehicle should be built, making changes like these was a matter of math.

Automotive Logistics warned that tariff-driven price shocks could slow or halt production if supply chains failed to adapt. Media procurement teams took that seriously, building what you might call “tariff command centers," cross-functional teams that stress-test bills of materials, reclassify components and model worst-case scenarios.

A New Steel Landscape: Nippon Steel Acquires U.S. Steel

Amidst all the tariff chaos, the most strategic shift of the year came from the supply side. Nippon Steel’s $14.9 billion acquisition of U.S. Steel formally closed with unprecedented federal oversight via a “golden share," giving Washington unusual influence over key decisions. After months of political and union resistance, the deal moved forward with new conditions and assurances to U.S. stakeholders.

Nippon committed $11 billion in U.S. upgrades and is expected to introduce more advanced automotive-grade capabilities. Its global capacity will reach approximately 86 million tons, giving automakers another technologically capable, well-capitalized supplier. Meanwhile, Cleveland-Cliffs sharpened its focus on operational efficiency and its automotive franchise. Still, pricing gaps persisted. For instance, by May, U.S. steel was about 77% more expensive than European steel, while aluminum carried a premium of roughly 139%.

In the end, the lesson for 2205 is that tariffs giveth, and tariffs taketh away.

Automotive MMI: Noteworthy Price Shifts

- Hot-dipped galvanized steel prices rose by 7.72% to $1,061 per short ton.

- Chinese lead prices moved sideways, dropping a slight 0.99% to $2,399.77 per metric ton.

- Lastly, Korean aluminum 5052 premium coil over 1050 prices increased 4.55% to $4.25 per metric ton.